What is Financial Independence?

The idea to achieve Financial Independence should be the ultimate aim for every individual. Although, there can be a debate that the ultimate goal of life is to be HAPPY. But, to a major extent, financial independence leads the path to happiness.

However, in the spiritual sense, the definition of happiness is altogether a different concept and is itself a vast topic.

For instance, you can say you are financially independent if you are able to buy a cookie to a street child. But on the spiritual perspective, that street child is happy in spite of being deprived of what we call our basic necessity (food, clothing, and shelter). So, in a way, happiness can be considered as someone’s individual mindset from the spiritual point of view.

Coming back to the pivot point of Financial Independence, the Wikipedia definition says, it’s the state of having sufficient wealth to spend life without even working. So if you are able to earn considerable income from single or multiple sources other than your primary occupation, that can meet your daily expenses comfortably, then you are the one who has attained financial independence. People who are in this state have their assets which generate income in passive form. Passive income is that income which you earn without having to work on a regular job.

In the earlier days, achieving financial independence wasn’t an easy task as there used to be a single earning member in the family. His primary focus used to be the upbringing of the members of the family providing the basic needs of life. This burden of responsibility was enough for the head of the family grow old and retire.

Although there were some traditional banking investments and deposits made by our parent’s generation, there wasn’t anything as such prior to that, i.e. during our grandparent’s era. However, we are grateful that our upbringing was done with all basic necessities of life.

Today, you can follow some basic strategies to achieve financial independence. Understand and plan your asset & expenses ratio. Below are some well known and more or less traditional non-exhaustive lists of sources of passive income that can potentially yield financial independence.

- Rental property

- Dividends from stocks, bonds, and income trusts

- Bank fixed deposits and monthly income schemes

- Royalty from creative works, e.g. photographs, books, patents, music, etc.

- Interest earned from deposit accounts, money market accounts or loans

- Business ownership (if your business does not require you to operate)

- Patent licensing

- A trust deed (real estate)

Well, more or less, all the above-mentioned ways need sufficient knowledge and investment budget (money) in the initial stage to earn a passive income at a later stage.

So, what advantage we can take from the 21st Century?

Unlike the last centuries, the advancement of the 21st century has bundles of opportunities for all age groups. Due to the limitless exposure around us, we can set our goals high, dream big and look for earning some passive income that helps us to add some extra enjoyment to life. But we hardly take the next steps to fulfill our dreams to live happily.

As Bill Gates rightly said, “If you are born poor, it’s not your mistake. But if you die poor, it’s your mistake.”

Therefore, never, ever settle with less!

At the same time, doing the right thing, in the right way, and through the right system is very important. One primary tip is to set your goal right. Your Goal should always be to increase your income and never focus on controlling or cutting down your expenses (unless you are consciously wasting your money).

In other words, the first step towards attaining financial independence is to build the attitude of considering yourself a rich person. The thought process with this active and right mindset will get your half job done. The next step becomes your decision making attitude towards the right opportunity.

What is the right opportunity for Financial Independence?

The answer is Network Marketing. Yes, Network Marketing, Multi-level Marketing (MLM) and Direct Selling Agent (DSA) are more or less known terms to all of us. And additionally, these are the most ignored and least considered profession by the majority of the people. If you ask a reason for that, you will hardly get any valid solidified answer from the person who rejected it. Or the probable answers for rejections may be; ‘these are meaningless’, ‘fake company’, ‘doesn’t work’, ‘hard to convince people’, ‘I can’t sell’ etc etc etc…

Most Importantly, the truth is that you don’t know how to excel in Network Marketing. Like all other industries, direct selling is also a big industry having its own benefits and glorious future. As per FICCI and KPMG Projections, Direct sales in India will reach Rs. 64500 crore by 2025 and there will be an estimated 1.8 crore direct sellers in India, 60% of whom will be women. So data and statistics can’t be fake or wrong. They are only results based on facts. Getting Associated with a reputed Direct Selling Company gives the right opportunity for financial independence.

And hence again, choosing the right company in Network Marketing is very crucial for generating long term passive income and leading to your financial independence. Just the way a decision can make your life or even break your life, choosing the appropriate authentic direct selling company is very essential to fulfill your dreams and generate passive income lifelong.

Similar to other skills, selling is no doubt an unique skill and we are born with this skill. In network marketing, we just need to sharpen our selling skill and the result will reflect in your income figures. Trust the process, its the easiest and fastest way to multiply your income within a short span of time. Additionally, the scope is also limitless and ever growing where you not only fulfill your own dreams but encourage and help your team members to fulfill theirs too.

Therefore, the next question can be; does Network Marketing have the capability to offer Financial Independence? If yes, which Direct Selling Company to consider?

And in conclusion, the answer to which would be….

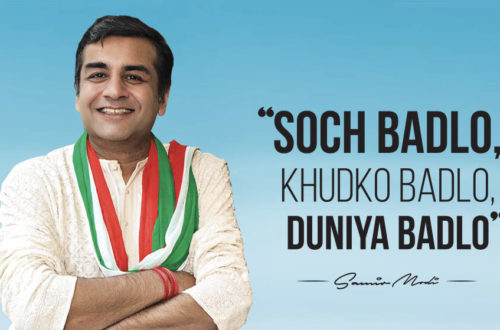

Welcome to MODICARE – India’s First Direct Selling Company started in 1996.

Like our Facebook Page: Jio Azad

One Comment

Pingback: